Both of these patterns can be a great way to spot reversals in the market. Like the strategies and patterns we trade, there are certain confluence factorsthat must be respected. More often than not a break of wedge support or resistance will contribute to the formation of this second reversal pattern. This gives you a few more options when trading these in terms of how you want to approach the entry as well as the stop loss placement. One of the great things about this type of wedge pattern is that it typically carves out levels that are easy to identify.

While the market formed a new lower low, the RSI did not confirm it. Wedge Trendlines Pattern Indicator for MT4 is a Metatrader 4 indicator and the essence of this technical indicator is to transform the accumulated history data. Overall, USD/MXN stays inside a bullish chart pattern but the buyers need validation from 18.15 to retake the control. The inverse is true for a falling wedge in a market with immense buying pressure. As you may have guessed, the approach to placing a stop loss for a falling wedge is very similar. While both patterns can span any number of days, months or even years, the general rule is that the longer it takes to form, the more explosive the ensuing breakout is likely to be.

What happens after a rising wedge?

I have explained below a wedge pattern forex to trade a wedge pattern effectively. Between 60% to 70% of the time, the wedge patterns are likely to break in the direction of the prevailing trend. Therefore, there is a considerable success rate, given how often this pattern can appear on Forex charts. As mentioned earlier, the Wedge Trendline indicator plots trendlines by connecting prominent swing highs and swing lows. Traders can trade on the actual momentum breakouts or wait for the pullback and rejection of the broken trendline to confirm the trendline breakout setup.

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

The falling wedge is a bullish pattern that signals the continuation of the upward trend or the reversal of the downward trend. If the rising wedge forms after an uptrend, it’s usually a bearish reversal pattern. Now the next step is to look for breakout of the first trend line in the ascending wedge.

Chart patterns

Another helpful sign to watch for involves to what extent the rising wedge has retraced the preceding downtrend. If the rising wedge has advanced beyond the downtrend’s 50% Fibonacci retracement level, then this may not be a valid bearish pattern. If the 50% retracement level remains unbroken, then a bearish rising wedge pattern remains possible.

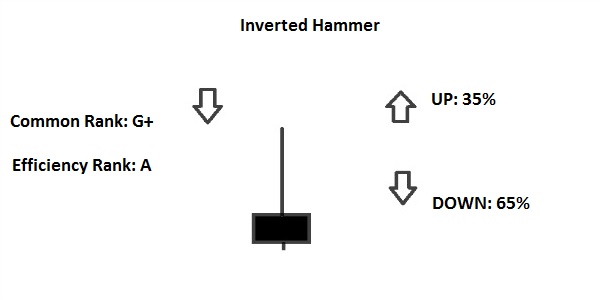

Candlestick patterns are created by one or more individual sticks on a chart. As ever, careful trading and strong risk management are also key. As you can see in the chart above, the market plummeted back when the price increase came to a halt. Let’s imagine the EUR/NZD market has been decreasing for some time because interest rates in New Zealand have been improving compared to the eurozone.

Double Bottom Pattern: A Trader’s Guide

This looked like shift in momentum, but we didn’t have much confidence with that yet. Hence, according to our rules, sellers should exhaust during the wedge and buyers will win – the up move should continue. Consequently, this wedge should be a continuation pattern – so that has happened.

It also connects the swing lows with other swing lows in order to form a diagonal support line. In the illustration above we have a bearish pin bar that formed after retesting former support as new resistance. This provides us with a new swing high which we can use to “hide” our stop loss.

While they can be useful for predicting price action, when a pattern emerges there’s no guarantee of what will happen next. So, most traders will wait to confirm their anticipated move – whether it’s a new trend, a reversal or a continuation – before opening a position. Even a little breach of the support can trigger a sharp drop as breakout traders enter a short position. However, selling at this point might be risky because lower prices may attract new buyers, causing the price to rise above support. A symmetrical triangle is a chart pattern characterized by two converging trendlines connecting a series of sequential peaks and troughs.

Smart traders know that forex wedge patterns can present a wealth of trading opportunities. When the price breaks the upper trend line, the security is expected to reverse and trend higher. Traders identifying bullish reversal signals would want to look for trades that benefit from the security’s rise in price.

A doji is a trading session where a security’s open and close prices are virtually equal. This usually occurs when a security’s price has been rising over time, but it can also occur in the midst of a downward trend as well. As a reversal signal, it is formed at a bottom of a downtrend, indicating that an uptrend would come next. There are two options here, either to trigger a trade just after breakout of the trend line or to wait for retracement to the Fibonacci 50 level. Here you will use your common sense and calculate risk reward ratio for each case.

What is the Wedge pattern? Characteristics and how to identify

Open a buy order as soon as a https://g-markets.net/ candlestick breaks above the resistance line with strong momentum. Traders can use trendline analysis to connect the lower highs and lower lows to make the pattern easier to spot. A break and close above the resistance trendline would signal the entry into the market. The descending wedge pattern appears within an uptrend when price tends to consolidate, or trade in a more sideways fashion. Once new sellers have opened their positions and the market has shown retracement – new buyers step in, i.e. those who want add to their positions and those who want to buy initially. Then, those sellers, who were not in time to enter during first move down or decided to wait for some retracement will attempt entering short at this second possibility.

Commodities Bearish Pattern Suggesting Lower Inflation? – Investing.com India

Commodities Bearish Pattern Suggesting Lower Inflation?.

Posted: Fri, 10 Mar 2023 08:00:00 GMT [source]

With prices consolidating, we know that a big splash is coming, so we can expect a breakout to either the top or bottom. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. Learn how to trade forex in a fun and easy-to-understand format. For more information, please see our Cookie Noticeand our Privacy Policy. The author has not received compensation for writing this article, other than from FXStreet. Oversold RSI, mildly upbeat MACD signals suggest that Mexican Peso pair bears are running out of steam.

Natural gas technical outlook: falling wedge remains in play on the … – IG

Natural gas technical outlook: falling wedge remains in play on the ….

Posted: Sun, 19 Mar 2023 07:00:00 GMT [source]

Wedges are reversal patterns as the price breaks out in the direction opposite of the wedge direction, but in the same direction as the prevailing trend. A decrease in volume during the consolidation phase increases the chance of a strong breakout. The articles below delve into some of the more common chart patterns used to trade the financial markets, particularly forex. Learn how to spot the formations and how to incorporate them into your strategy. The next section will describe how to use a rising wedge pattern strategically when trading currencies to help you incorporate the rising wedge pattern into your forex trading plan. The first thing to know about these wedges is that they often hint at a reversal in the market.

These three patterns all look a little bit different but are similar in how they work. Symmetrical triangles, flags and wedges are all formed by two trend lines that indicate indecision in the market. Then, if either trend line is broken, they may lead to a new rally in that direction. Technical analysis is based on the principle that chart patterns will repeat themselves, resulting in the same price action most of the time. In other words, the rising wedge transforms into a bullish continuation pattern while the descending wedge transforms into a bearish continuation pattern.